Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

TL;DR: We’re human and we’re heading on summer vacation starting tomorrow (back 7/22), but before we go… we’ve got ATHs, ETH tailwinds, and the full breakdown of the most anticipated ICO in Solana history. Let’s finish strong.

☀️Out of Office: Activated

Starting tomorrow, we’re officially unplugging for the next 12 days. No newsletters, no charts, no price alerts — just good vibes, cold drinks, and some well-earned downtime. We’ll be back July 22nd, recharged and ready to melt faces.

But first…let’s get to the signals that matter before we disappear.

📈Bitcoin Breaks $112K. Ethereum Heating Up at $2,800.

$BTC.X ( ▼ 0.71% ) just tagged a new all-time high. $ETH.X ( ▼ 0.18% ) is dancing at $2,800. A clean break sends it straight to $3K+.

But forget the price for a second — just look at this setup:

ETH/BTC at 5-year lows

MVRV Z-Score at 0.37 (5-year avg = 1.04)

43% of ETH locked in smart contracts (near ATH)

29% of ETH staked (also ATH)

ETH trading at its 200-Week SMA (historically a slam-dunk entry)

L1 loan activity at ATHs

Stablecoin supply = $139B (also ATH)

1.3M ETH in strategic reserves (1.01% of supply)

4.1M ETH now held in ETFs (3.4% of supply)

Only 13.5% of ETH left on exchanges (lowest since 2016)

Tom Lee calling ETH the “ChatGPT of crypto” on CNBC

Joe Lubin casually saying they’re acquiring “tens of millions of ETH/day”

Robinhood building on Arbitrum

Banks and fintechs prepping to issue stablecoins

Fed pressure building for rate cuts

If you’re still bearish on ETH, you’re just not paying attention.

💊 PumpFun’s $4B ICO Confirmed. Here’s the Full Breakdown.

After weeks of speculation and leaks, PumpFun has officially dropped the details of its upcoming token launch — and it’s shaping up to be one of the most polarizing events in crypto this year.

🔓 Launch Details:

ICO Date: July 12

Valuation: $4 billion

Venues: PumpFun directly + 6 major CEXs

KYC Required: Yes

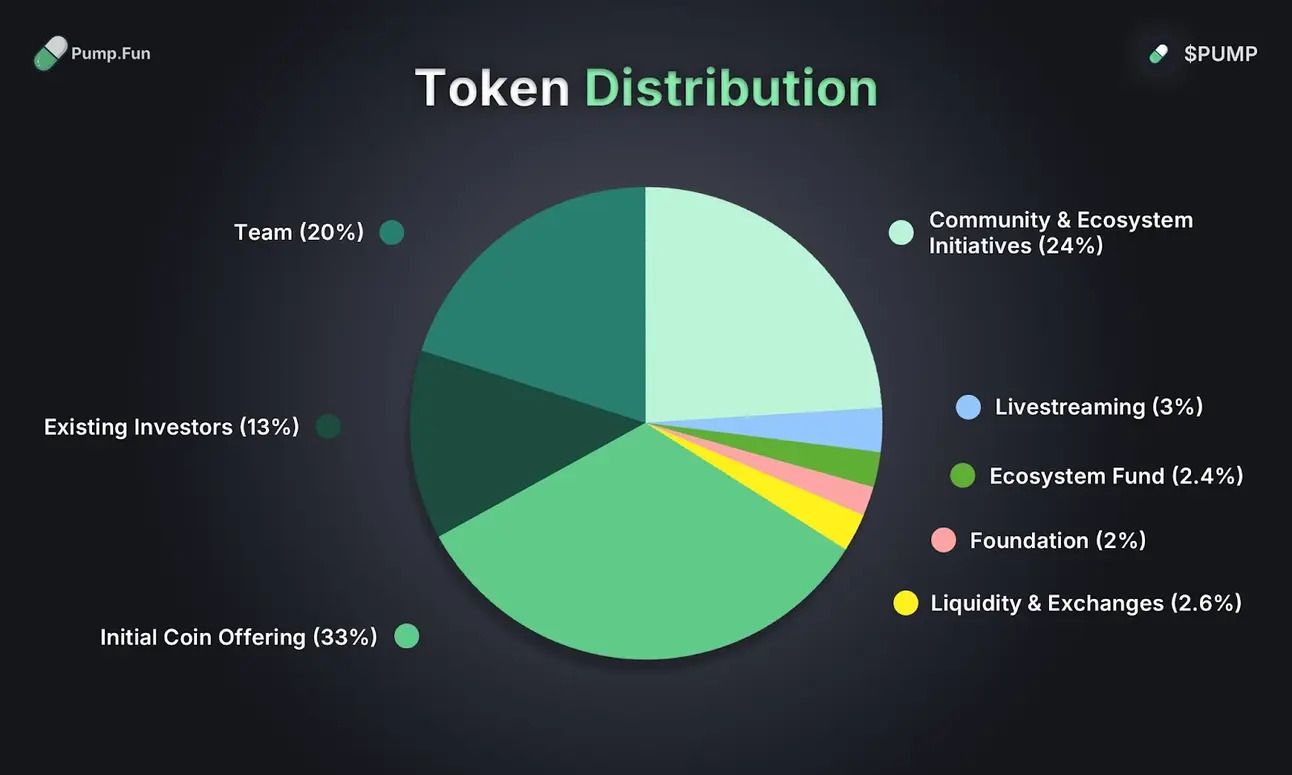

📊 Tokenomics:

33% → ICO

24% → Community + Ecosystem Initiatives

20% → Team

13% → Existing Investors

Remainder → Foundation, Liquidity, Livestreams, etc.

🚨 An airdrop has been teased, but not confirmed. Many believe the “Community & Ecosystem Initiatives” slice could be related.

🧠 Context:

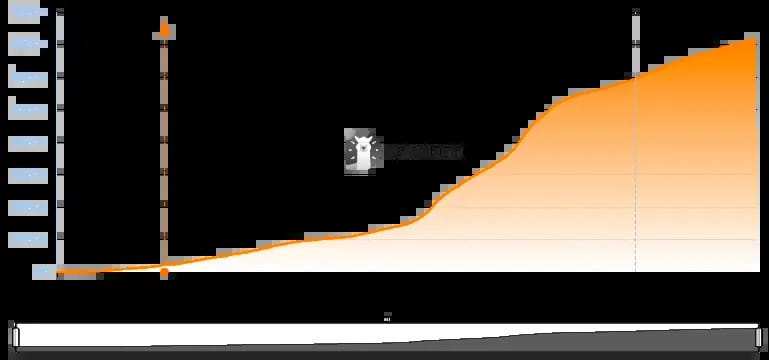

Cumulative revenue

PumpFun generated $715M in revenue since launch in Q1 2024.

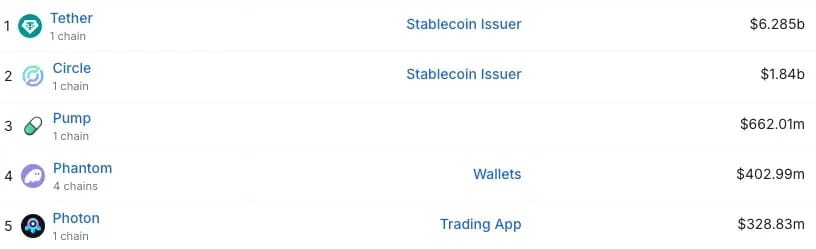

Currently the #3 most profitable protocol in DeFi behind only Tether and Circle.

$662M earned in last 365 days — that’s more than Phantom, Photon, or any NFT platform.

Top 5 DeFi earners over the past year.

Despite the criticism around extractive design, some (like Messari’s Sunny Shi) are projecting a $7–$20B valuation, depending on token sinks like rebates and buybacks.

It’s a bet on one thing: whether memecoins as a sector will remain hyper-financialized and vertically integrated. If the answer is yes, PUMP could dominate the launchpad stack the way Uniswap dominates swaps.

📈 Pump’s TVL Is Still Mooning

Even after an infrastructure hack back in May, Pump’s TVL continues to climb:

Currently over $700M — and still rising.

This kind of post-hack resilience speaks volumes. Retail didn’t flinch. Builders kept building.

💣 Final Take

The memes are maturing. The ETH thesis is locked. And if this summer push keeps rolling, we could be looking at the moment retail and institutions collide — all while we’re sipping mojitos poolside.

This is the setup.

Take it in.

Then go touch grass.

🟨 Reminder: We’re off until July 22. No newsletters. No tweets. Just pure summer.

It’s go time.

-Cole 🍹