It’s the freakin’ weekend! We made it. It’s here. Let’s get it kicked off right with a fresh ☕️ and a piping hot stack of token goodness to go with it.

TL;DR: Onchain AI markets continue to surge, with the overall agents marketcap up another 25%, while Virtuals leads in price performance and mindshare growth among the major "framework tokens.”

Part 1: The Next Financial Meta—AI Agents Managing Your Tokenized Assets

There’s a lot of noise in the AI x crypto space right now. Panels, pitches, hype decks. But Avery Ching—co-founder of Aptos Labs—cut through it all at Token2049 with a take worth your time:

“AI agents will manage portfolios of tokenized assets—real estate, stocks, bonds—entirely onchain. That’s the endgame.”

He’s not talking hypotheticals. He’s talking full automation of wealth management—by bots trained to allocate assets based on your personal risk, goals, and timeline. Think robo-advisor 10.0… but plugged directly into DeFi rails.

Here’s why this matters:

Real estate, pre-IPOs, bonds, and equities will move onchain. That unlocks 24/7 access, global liquidity, and composability with DeFi.

AI agents become your personal portfolio managers—allocating, borrowing, rebalancing in real-time across onchain markets.

Collateralization gets smarter—imagine using your tokenized home equity as collateral for a leveraged Solana yield strategy.

Ching also made a key point: blockchains are the defense layer against AI misinformation. Once something’s stored onchain, it can be timestamped, verified, and audited—even if AI tries to spoof or remix it later.

This convergence—AI agents + tokenized everything—isn’t 10 years away. The rails are being built now. And while it may start overseas (due to U.S. regulatory gridlock), the opportunity for early positioning is global.

TL;DR: The smartest players won’t just own tokenized assets. They’ll program agents to grow them.

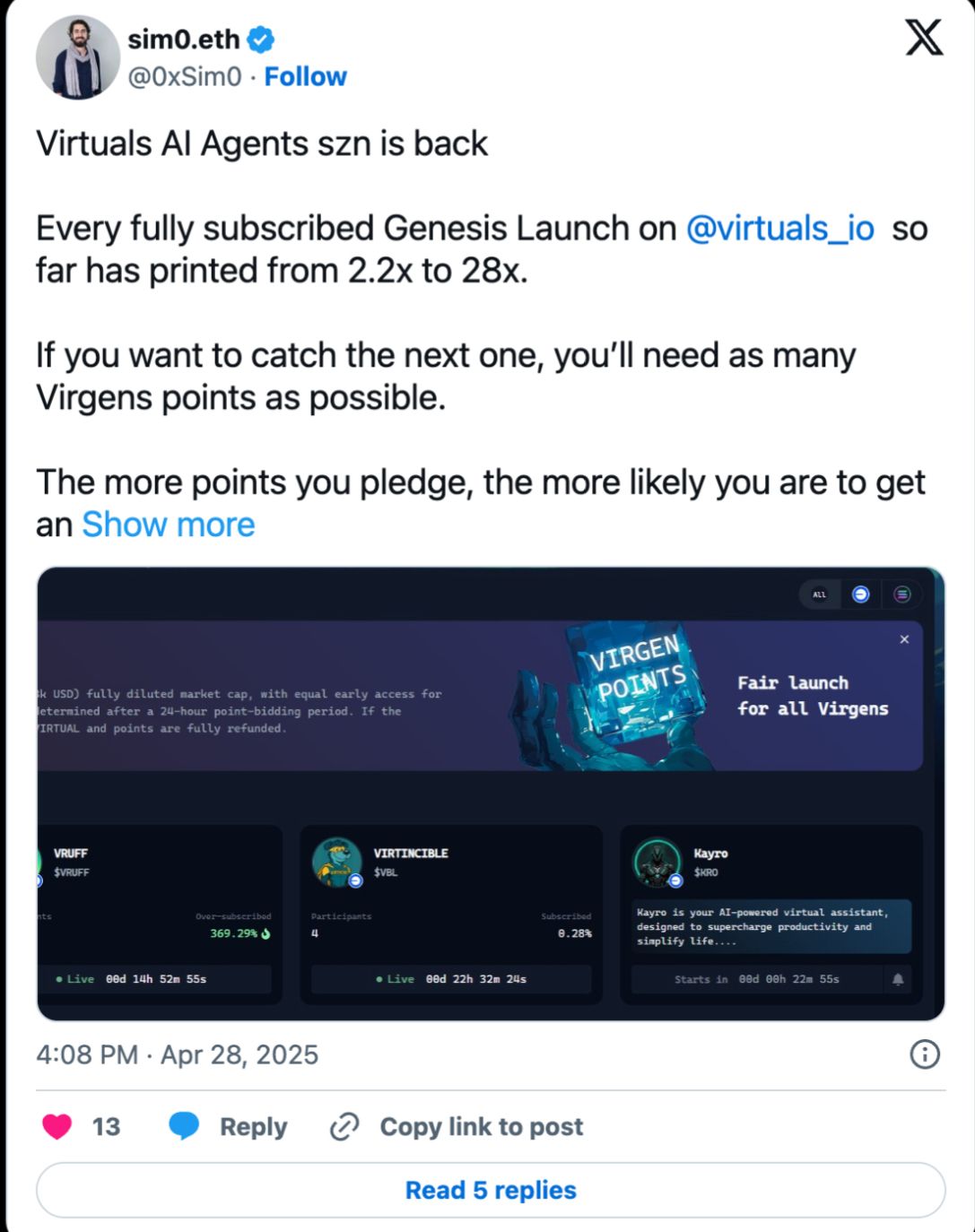

Part 2: How to Front-Run Virtuals’ Genesis Token Launches

If you’re new here and you’ve been sleeping on Virtuals, wake up. (Our readers are building👇🏼)VIRTUALS new token launchpad, Genesis, is quickly becoming one of the most effective early-access platforms in the game.

Here’s what you need to know:

What is Genesis?

Genesis replaces outdated bonding curves with proof-of-contribution. Your allocation isn’t based on size of wallet—it’s based on your ecosystem involvement.

You stake Virgen Points and $VIRTUAL.X ( ▲ 2.65% ) during a 24hr presale

You get up to 0.5% of the total supply, max

Unused points or tokens get refunded automatically

Dev tokens are vested and locked for transparency

This isn’t another pump-and-dump. Genesis is built to reward real participants—and it’s already delivering. Several launches have printed 2.2x to 28x returns so far.

How to Earn Virgen Points

There are three main strategies:

Hold or trade $VIRTUAL and agent tokens – Points stack based on size and duration of hold.

Stake approved tokens – Like $VADER, $AIXCB, $SHEKEL. Stakers get priority allocation.

Contribute content – Tweet, post, or write about Virtuals. Link your X account and submit proof via Typeform. It counts.

Pro tip: Holding Genesis tokens will soon earn points passively—just don’t forget to manually claim them within 24hrs.

How to Participate in a Genesis Launch

Pledge Virgen Points + $VIRTUAL in the 24hr presale

Get your estimated allocation (based on your share of points)

Commit enough $VIRTUAL (up to 566 max)

Adjust if others join and dilute your share

Finalize once allocations are locked. Excess is refunded.

How to Play This Smart

Don’t dump early – Selling Genesis tokens too soon = points penalty

Stack points where they count – Bigger launches mean more competition. Don’t waste points on low-conviction drops.

Read the vesting terms – Check if devs are locking their supply. If they’re not, that’s a red flag.

Focus on yield vs hype – Sometimes the best returns come from smaller, underhyped launches.

Final Take:

AI agents managing portfolios of tokenized assets is forming all around us. And while the world debates regulation and ethics, those reading CryptoNuggs and watching platforms like Genesis are already positioning for the next wave of wealth creation.

Stack points. Watch the vesting. Get the allocation. Exit smarter.

Stay sharp. Stay Nugg’d. Enjoy the weekend. ✌🏼

-Nick

Founder, CryptoNuggs