Today’s Nugget:

Crypto exchange volume is collapsing, traders are piling into futures, and the market is quietly shifting under the surface.

Today we break down exactly what’s happening — and more importantly, how you can profit while everyone else is confused.

Let’s get into it:

Spot Volume Collapses to 6-Month Low

After a small pop in early April (fueled by President Trump’s tariff announcement market volatility), crypto volumes have fallen off a cliff.

According to The Block’s latest data:

Total 7DMA exchange volume just clocked $32 billion — the lowest since mid-October 2024.

That’s a 75% crash from the December 2024 peak of $132 billion.

DEX volumes (on-chain trading) are also on pace for their weakest month since October.

Even crypto ETFs — which had been resilient — are cooling:

Spot Bitcoin ETF volume last Thursday was the lowest since March 25.

Spot Ethereum ETF volume was the lowest since March 27.

Traders Flee Spot for Futures

Not only is spot volume dropping — but the ratio of spot to futures is hitting multi-year lows.

Key stats:

BTC Spot/Futures Ratio: Now at 0.19 — lowest since August 2024.

ETH Spot/Futures Ratio: Now at 0.20 — lowest since December 2023.

What that means:

Spot = Real buyers taking ownership of crypto.

Futures = Speculators betting on price swings with leverage.

Lower spot ratio = More speculation, less real accumulation.

The market is dominated right now by short-term, leveraged trades — not strong-handed investors.

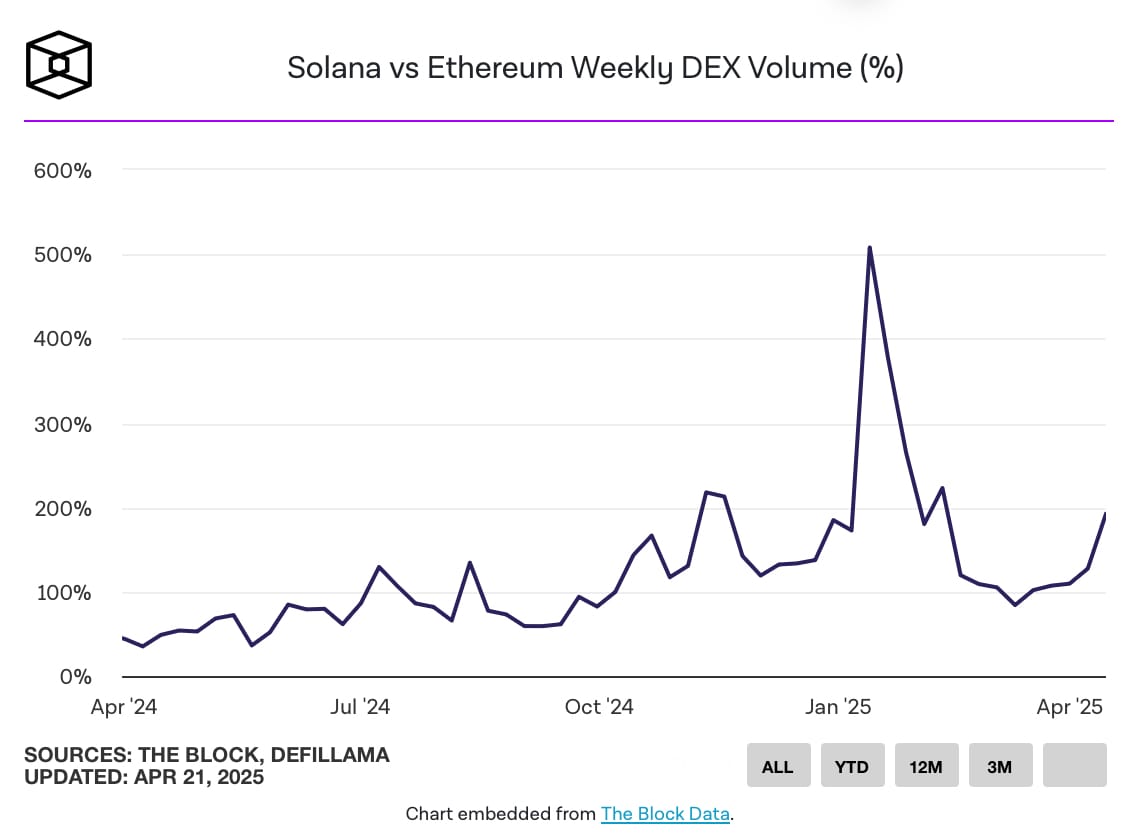

Solana Quietly Flexes Strength

While Ethereum’s spot activity fades, Solana is showing a subtle but important uptick.

The Block’s data shows:

Solana’s weekly DEX volume relative to Ethereum $ETH ( ▼ 0.11% ) has been rising since mid-March.

Solana $SOL.X ( ▲ 1.16% ) captured 70% of total crypto app revenue on one day last week.

Translation:

SOL is quietly regaining user and liquidity traction.

Strong “on-chain fundamentals” while others pull back.

Current Market Snapshot (as of April 21, 2025)

Here’s how majors are moving right now:

Asset | Current Price | 7-Day Move | Key Insight |

|---|---|---|---|

Bitcoin (BTC) | $87,214 | +2.7% | Fresh breakout, but volume weakening. Caution on leverage spikes. |

Ethereum (ETH) | $1,628 | -2.7% | Struggling. Losing momentum vs BTC and Solana. |

Solana (SOL) | $138.67 | +4.0% | Leading alt strength. Watching for continuation above $140. |

BNB (BNB) | $601.89 | +1.7% | Stable. Still lagging broader alt momentum. |

XRP (XRP) | $2.12 | +1.7% | Bouncing but lower high structure. Needs confirmation. |

Immediate Trend Summary:

BTC dominance remains high, but futures heavy.

ETH shows relative weakness.

SOL quietly showing leadership among top assets.

Actionable Insights

Expect Volatility to Increase

When spot dries up and futures dominate, it takes less capital to move prices.

Whipsaws and fakeouts become more common.

Tight stop-losses and scaling into positions = survival.

Watch Solana-Based Opportunities

If Solana strength persists:

SOL could outperform ETH near-term.

Look at SOL ecosystem plays like Jupiter, Drift, Kamino for stronger upside.

Caution on Ethereum

ETH/BTC ratio is near multi-month lows.

ETH weakness + low spot activity = limited upside until a real catalyst emerges.

Be Defensive, but Ready

Low spot volume and high futures positioning = ripe for liquidation cascades.

Manage risk tighter.

Keep powder dry for real entries after wipeouts.

Final Nugget:

This is not the time to chase pumps blindly.

This is the time to sharpen your edge.

When spot dries up and futures dominate,

markets are controlled by fast hands, not strong hands.

The winners?

Smart traders who anticipate volatility, not react to it.

Builders who quietly prepare for the next liquidity wave.

Investors who accumulate smartly during boredom, not hype.

Stay sharp. Stay ahead. Stay Nugg’d.

-Nick

Founder, CryptoNuggs

⚡ If today’s Nugget made you smarter, share it with 3 friends who are still trading like it’s 2021.