Today’s Nugget:

Deloitte just dropped a bombshell: global tokenized real estate could hit $4 trillion by 2035.

What was once a fringe DeFi concept is now being engineered by Wall Street and Big Tech — and the rails are being laid right now.

If you want to front-run the next $4T narrative, this is your map.

Let’s break it down.

Tokenization’s Next Frontier: Real Estate

According to a Deloitte Center for Financial Services report:

Tokenized real estate is forecasted to grow from under $300B today to $4T by 2035

That’s a 27% CAGR, with most of the growth starting now through 2030

Tokenization will transform how we finance, own, and trade property

The benefits?

Faster settlement times

Broader investor access

Fully automated fund flows + ownership transfers

Real estate goes 24/7, programmable, and permissionless

Where the Value Will Be Captured

Deloitte’s breakdown of tokenized real estate in 2035:

Securitized loans: $2.39T

Private real estate funds: $986B

Undeveloped land: $501B

Plus real estate REITs and tokenized mortgage instruments

This is not about flipping metaverse plots.

It’s about:

On-chain funds like Kin Capital’s $100M debt fund on Chintai

Tokenized deeds backed by real income streams

Infrastructure that handles compliance, ownership, and payouts

And guess what?

This isn’t just a TradFi play.

The blockchains, protocols, oracles, and rails that power all this will also explode in value.

ACTION ZONE: Who’s Winning Right Now

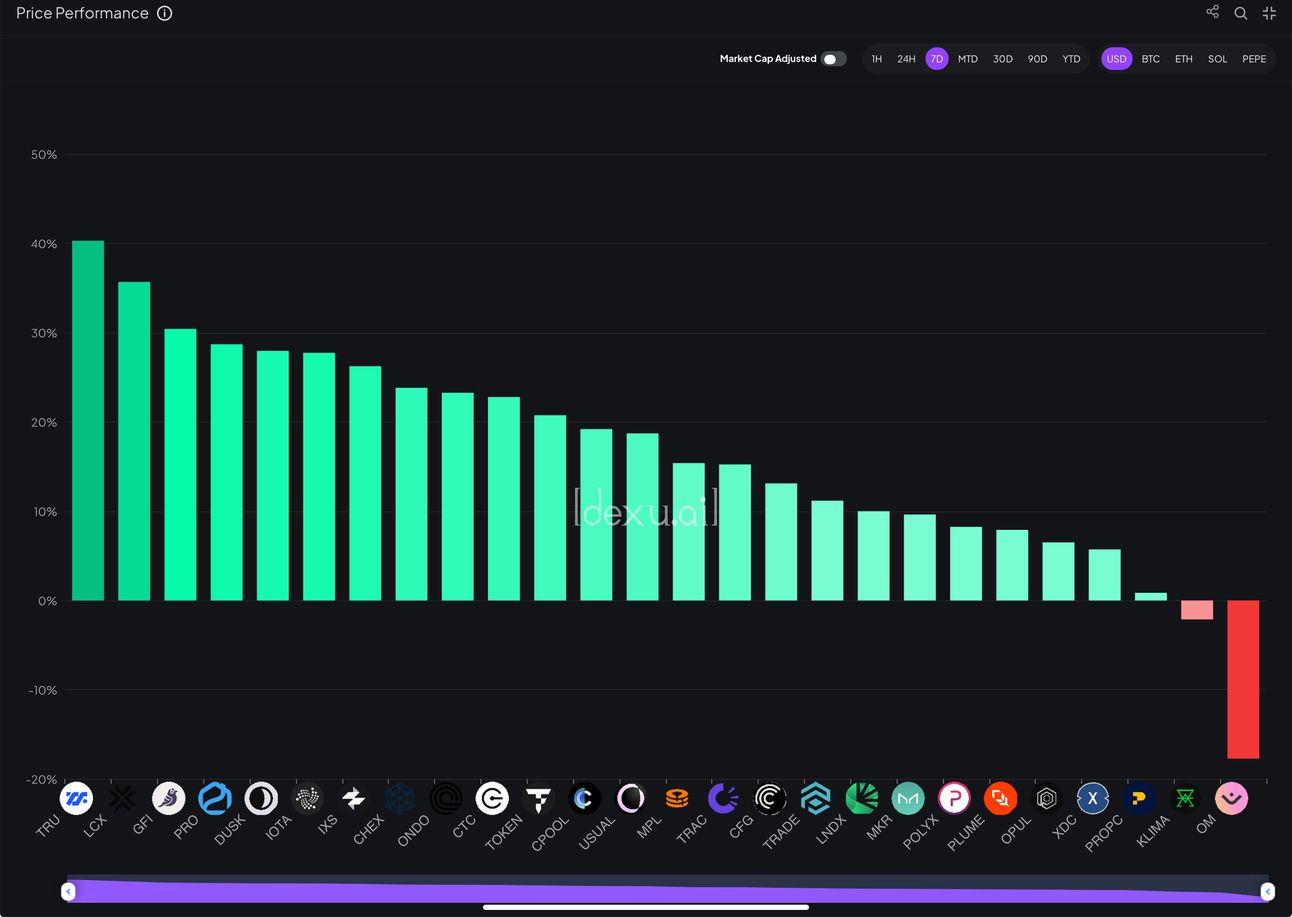

Here’s where smart money is moving — based on real-time data from LunarCrush, CoinGecko, and Dexu.ai.

1. ONDO Finance (ONDO)

$1.02 (+15.6% 24h) | +23% 7D

$680M daily volume — highest in RWAs

Top gainer. Top trending. High bullish sentiment.

Why it matters:

ONDO is tokenizing treasuries and has institutional backing. It’s the clear leader in the tokenized yield narrative.

If RWAs are the next stable, ONDO is the USDC of that ecosystem.

Playbook: Momentum + thesis alignment. Ride the wave, but protect gains.

2. Chainlink (LINK)

$15.22 | +20.4% 7D

$490M volume

Quietly securing its role as oracle infra for RWAs

Why it matters:

Every tokenized asset needs data and price feeds. Chainlink is positioning as the backbone of tokenized markets.

It’s the plumbing behind the trillions.

Playbook: Long-term infra hold. Accumulate on dips.

3. Clearpool (CPOOL)

Market cap: $121M

24h AltRank jump: +1.04K

Bullish sentiment: 92%

Why it matters:

Decentralized credit markets will be essential for RWA lending. CPOOL’s still early and undervalued.

Playbook: High-upside asymmetric bet. Use tight stops, monitor volume.

4. CryptoAutos (AUTOS)

24h gain: +33.5%

AltRank rocket: +1.79K

Microcap: $7.5M

Why it matters:

Speculative, social-powered momentum. Riding the tailwind of tokenized car ownership narratives.

Playbook: Only for traders. Ride the social wave, set tight trailing stops.

5. Algorand (ALGO)

Ecosystem up +17.85%

Strong infra presence in tokenized asset pilots

Why it matters:

ALGO’s been overlooked, but has real traction in institutional-grade RWA use cases.

Playbook: Early infra accumulation play. Patience required.

Bonus Alpha: BUIDL Isn’t Moving… Yet

BlackRock’s BUIDL token is still flat at $1.00 — no speculation baked in yet.

But it’s:

Backed by US Treasuries

Fully tokenized

Institutional-grade

The price isn’t moving, but the implications are massive.

If the world’s largest asset manager is tokenizing yield… you should be building around that.

Final Nugget:

The tokenized asset wars have begun.

$4 trillion in real estate is coming on-chain.

Big banks are experimenting.

Stablecoins are already laying the rails.

And retail is barely paying attention.

Don’t chase hype. Chase infrastructure.

Invest in the plumbing.

Bet on protocols that power the real economy.

Position early in what TradFi will need to use.

Because this time, it’s not just a narrative.

It’s the new foundation.

⚡ If you got value from this drop:

Share CryptoNuggs with 5 friends and we’ll send you:

A CryptoNuggs hat

Our ChatGPT Research Assistant prompt kit for 10x smarter investing

Let’s front-run the institutions — together.

-Nick

Founder, CryptoNuggs