Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

We’re back from beach mode (barely) ☀️

And while we were floating in the ocean, the crypto markets were heating up:

$ETH.X ( ▼ 0.72% ) printed 9 green daily candles…9!!! 🟢

$XRP.X ( ▼ 0.49% ) ripped to an all-time high

And our beloved $REKT.X ( ▼ 3.2% ) hit ATH and is en route to deleting another zero

Let’s keep it light today and focus on a simple truth:

Bitcoin was a blueprint.

Ethereum is the working product.

🧠 Bitcoin: Hard cap, soft defense

Bitcoin fixed supply at 21 million coins. Sounds solid.

But the network still needs to pay for security, or it risks collapse.

Right now, the security budget comes from two things:

Block rewards (cut in half every 4 years)

Network fees (which are nowhere near enough)

📉 Currently, fees contribute less than 10 BTC/day, only ~1% of what miners earn.

As halvings keep slicing rewards and Bitcoin aims for trillion-dollar market caps, the security budget shrinks… just as the attack incentive grows.

Lower pay = fewer miners = weaker defense.

A big enough attacker could rent the hardware to take over Bitcoin for a rounding error of its market cap.

This is the security ticking time bomb that Justin Drake keeps warning about.

🔥 Ethereum: Burn + Bond + Boost

Ethereum took a different route:

Swapped PoW for bond-backed validators (Proof of Stake)

Introduced EIP-1559: burn a piece of every transaction

Only issues ETH to pay for validator security

Here’s the twist:

When network activity spikes, the burn exceeds the issuance → net supply shrinks.

That’s why ETH is flirting with being the most deflationary mainstream asset ever created — while still paying for its own security.

🚀 The Flywheel in Motion

Every new app, stablecoin, or rollup:

→ drives more network activity

→ burns more ETH

→ increases staking yields

→ attracts more stakers

→ deepens security

→ feeds the cycle again

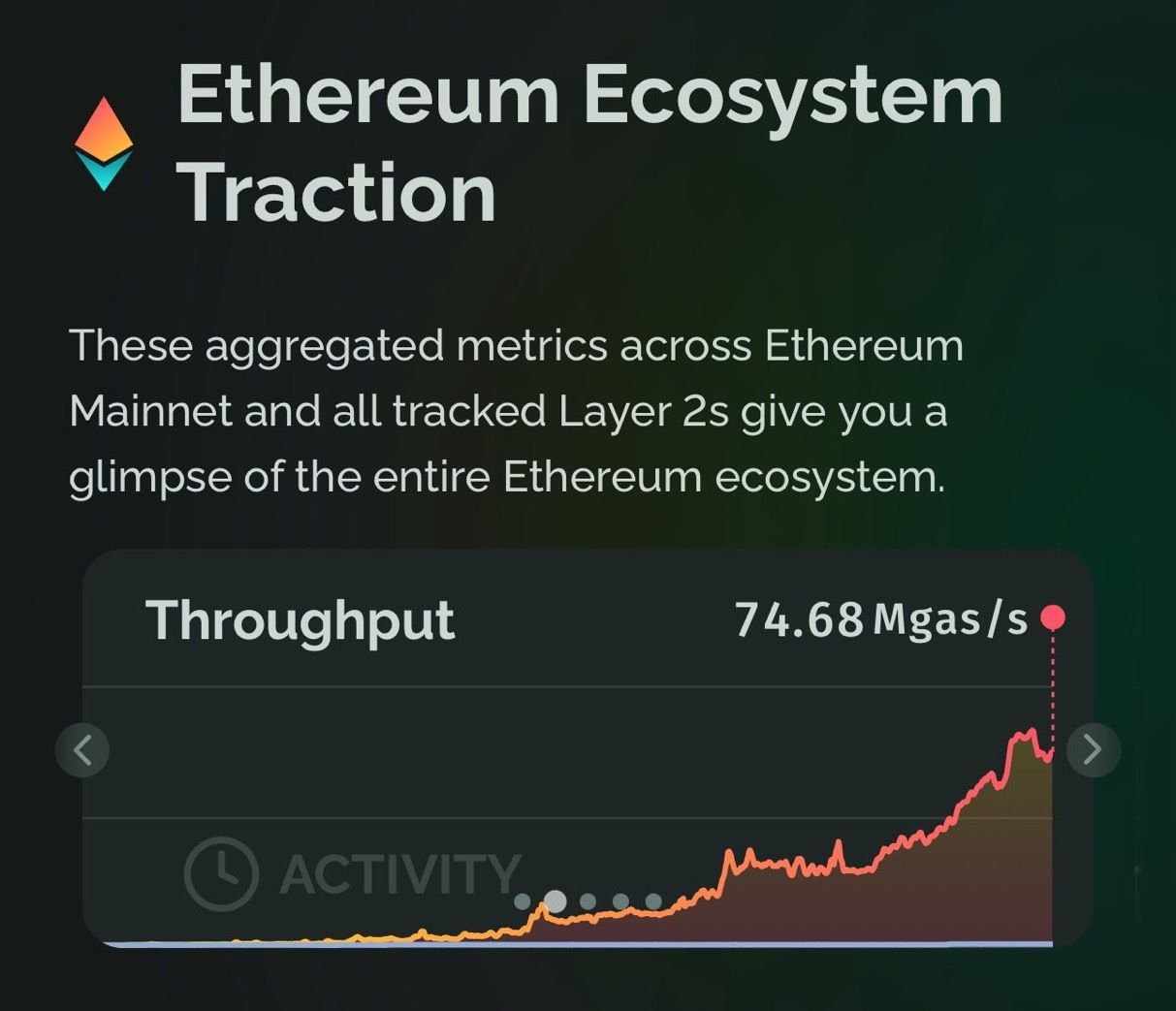

That’s the Ethereum flywheel. It’s not theoretical — it’s happening now.

📊 Supply Crunch: ETH vs BTC

Let’s hammer this home:

One way to look at $ETH right now:

@SharpLinkGaming & @BitDigital_BTBT have, in just one month, eaten up 82% of all the net-new ETH issued since the Merge (298,770 ETH).

Spot ETFs already hold 4.11M ETH — that’s 11x more than what has been newly issued.

Imagine an oil mine that produces 1 barrel a day…

…and Wall Street guzzling 6.

That’s ETH in 2025.

Add in:

Negative net issuance during fee spikes

Native yield staking

Institutional inflows = Supply-side death spiral for ETH bears.

💬 Important note:

We’re not maxis.

Bitcoin and Ethereum can absolutely coexist.

BTC is the pristine monetary asset.

ETH is the programmable one.

Different tools for different missions — and both matter.

But when it comes to execution, real-time yield, and network-level sustainability…

Ethereum’s architecture gives it a structural edge for the future of onchain activity.

🧩 TL;DR: Why This Matters

If crypto is going to run real-world value, it needs a chain that:

✅ Scales

✅ Stays secure for decades

✅ Has monetary policy tied to real economic use

Ethereum isn’t just the best shot — it might be the only one.

The ticker is ETH.

The asset is programmable.

The upside is underestimated.

Grab it while it’s still $4,000 because we don’t think you’ll see it below $3,000 ever again.

-Cole