Let’s kick off the week by making one thing clear: DeFi is powerful, but it’s still a pain to use.

That’s where DeFAI comes in—and Q2 is proving this sector’s just getting warmed up.

We’ve mapped the whole DeFAI ecosystem below to show you who’s building what, and how the most important sub-sectors are evolving. But before we dive in, here’s why this matters:

The Problem: DeFi Is Still Too Hard

Even after a decade of building, DeFi is still too complex for most people. You need:

A Web3 wallet

Gas fees on multiple chains

Manual swaps and contract approvals

Constant attention to not get rekt

That’s not what “mainstream” looks like.

DeFi promised to make finance accessible. But it became a power user’s game. The average person? Still locked out.

The Solution: DeFAI

DeFAI = Decentralized Finance × Artificial Intelligence.

The mission? Strip away the complexity and let users actually use DeFi.

Think of it like how Google changed the internet. You used to need to know exact URLs. Then search engines made it one-click easy.

That’s what DeFAI is doing for crypto.

These tools let you type, prompt, or ask—and the AI handles the rest:

Deposits

Vault zaps

Token creation

On-chain execution

Strategy automation

No tabs. No wallets. No 37 steps. Just results.

And the market’s catching on fast:

DeFAI market cap is now $1.5B, with $565M in 24h trading volume, according to CoinGecko.

Q2 Ecosystem Overview: Who’s Building What

Here’s a full breakdown of what we’re seeing and who’s leading in each category:

Abstraction Layers

This is where AI makes DeFi feel human. Think ChatGPT for yield, swaps, token creation—whatever you need.

Top Players:

Neur $NEUR.X ( ▲ 2.37% )

Griffain $GRIFFAIN.X ( ▼ 1.93% )

Wayfinder $PROMPT.X ( ▼ 13.85% )

Mantis $M.X ( ▲ 0.73% )

HeyElsa $ELSA.X ( ▲ 1.96% )

ChainGPT $CGPT.X ( ▼ 0.86% )

Orbit Crypto AI $OIGBQ ( 0.0% )

The Hive $HIVE.X ( ▲ 1.94% )

AI Trading Facilitators

Helping traders automate alpha and make smarter plays with less effort.

Top Players:

HeyAnon (text-to-action DeFi yield tool) $ANON.X ( ▼ 8.14% )

Cod3x $CDX.X ( ▲ 0.31% )

Almanak

Gigabrain

GatsbyFi

Axal

Paal AI $PAAL.X ( ▼ 2.32% )

Cortex Protocol

Autonomous Agents

The bots that go full autopilot. Plug in, fund it, walk away—let the agent handle yield, strategy, and execution.

Top Players:

Maneki

Rekt $REKT.X ( ▼ 2.78% )

RNDM

BigTonyXBT

Velvet Capital

Kudai $KUDAI.X ( ▲ 2.0% )

Gigabrain Agent

Fungi Agents

Agent Frameworks

These are the OS platforms and backbones for building AI agents. You won’t interact with these daily, but they’re powering the future.

Top Players:

Virtuals (GAME)

elizaOS

Swarmnode

Autonolas

Hybrid

Loomlay

DeFAI Infrastructure

You can’t build a new financial system without rails. These teams handle data, compute, privacy, and AI-chain integrations.

Top Players:

Bittensor

Allora

Mode Network

Cookie

Hive Intel

Simplified: Why This Matters

DeFAI isn’t just a narrative—it’s solving a real user problem:

Crypto is too hard. AI makes it easier.

We’re seeing:

Mindshare momentum (HeyAnon, Virtuals, ChainGPT are trending)

Token traction (DeFAI tokens like PAAL, AIXBT, and ANON up 30–67% in 7D)

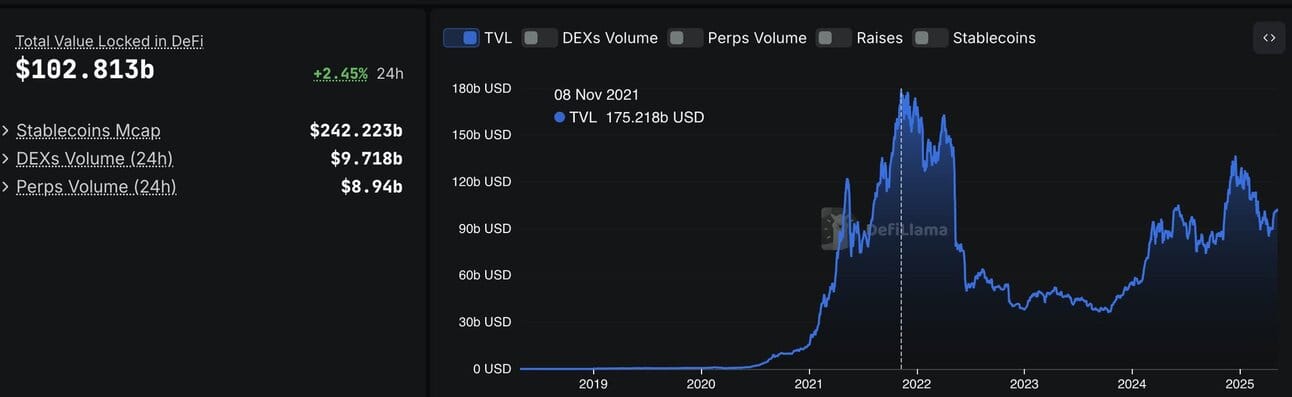

DeFi TVL rebounding ($102B locked today vs $175B peak in 2021)

This next wave won’t be about who builds the smartest protocol.

It’ll be about who builds the easiest one to use.

DeFAI is how we finally get there.

Stay ahead. Stay Nugg’d.

-Nick

Founder, CryptoNuggs