1️⃣ We Called It: VIRTUALS AI Goes Vertical

Remember the tiny AI‑inference project we flagged 4 weeks ago? VIRTUALS AI has now ripped +103 % this week and +213 % on the month. $VIRTUAL.X ( ▲ 2.65% )

Why the rocket fuel?

Liquidity tripled the moment Bybit listed the token, closing the spread for whales.

Its “model‑as‑a‑service” beta pulled 23 K testers in 48 hours, proving real demand.

AI still owns 32 % of all crypto social chatter (LunarCrush). Narrative = wind at its back.

Quick primer (for new subs): VIRTUALS treats AI the way AWS treats compute. DApps “rent” tiny models on‑chain, paying in VIRTUALS tokens instead of credit‑card swipes. If that doesn’t scream “picks‑and‑shovels,” nothing does.

2️⃣ Ethereum: From Quiet Confidence to Street Fight

For years the $ETH.X ( ▼ 0.18% ) crowd believed: “TradFi will inevitably settle on the most decentralized, battle‑tested chain (us).”

They weren’t wrong—but the victory lap is premature.

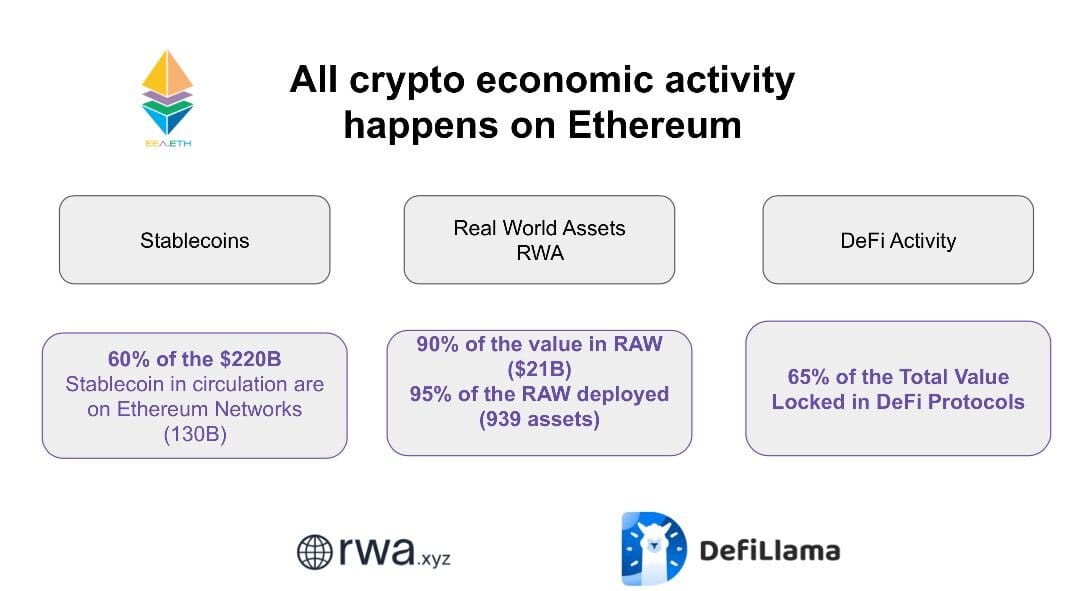

The scoreboard

57 % of tokenized real‑world assets ($5.98 B) reside on Ethereum.

Runner‑up ZKsync Era holds 21 %; everyone else is nibbling crumbs.

The big‑money vote

BlackRock’s BUIDL fund—the largest on‑chain money‑market product—just crossed $2.6 B AUM. A staggering 93 % of it sits on Ethereum even though the token exists on six other chains.

Blocksquare × Vera Capital inked a $1 B US‑real‑estate deal last week—Ethereum L1.

Securitize & Ethena announced “Converge L2” to pipeline billions more RWAs—again, Ethereum‑centric.

So what’s the problem?

“If it’s not minted on Ethereum L1, it’s bullshit.” — Sam Kazemian, Frax

Kazemian’s gripe: ETH holders are too polite. Bitcoin maxis scorched the earth to defend “digital gold.” ETH needs the same zealotry for tokenized assets.

Why? Because multi‑chain issuance dilutes Ethereum’s security moat. If Solana or Aptos suffers a contract exploit, every cross‑chain replica exposes the issuer—and indirectly, ETH holders—to that tail risk.

Translation for non‑techies: Imagine the same $100 note cloned onto seven blockchains. One faulty printer ruins the stack.

3️⃣ The Numbers Behind the Narrative

Metric | 7‑Day Δ | Nugget | |

|---|---|---|---|

RWA TVL (all chains) | $22.2 B | +10.9 % | Fastest‑growing crypto sector |

Tokenized Treasuries | $6.5 B | +5.5 % | Yield hunt accelerating |

ETH on CEXs | 8.97 M ETH | −1.1 % | Coins keep leaving exchanges (supply squeeze) |

Why you should care: Every dollar that tokenizes onto ETH burns gas, locks collateral, and reinforces its network effects—if the deals stay on L1.

4️⃣ BTC Heat Check — $3 B in Shorts, One Match Away

The market is obsessed with “Will Bitcoin finally print six digits again in May?”

Here’s the cold data $BTC.X ( ▼ 0.71% ) :

Roughly $3B in cumulative shorts pile up between $97K and $100K.

A push past $100 K could auto‑liquidate bears, forcing market buys and creating a vertical candle.

Glassnode’s cost‑basis ribbon just flipped all cohorts ≤ 6 months into profit (24‑h realized price = $95.2 K). That means recent buyers are no longer underwater—sell pressure evaporates right when shorts are cornered.

Playbook:

Set alerts at $99.5 K—the wick often triggers just below round numbers.

If longs print, trail stops—squeezes overshoot, then snap back.

Historically, a BTC spike dents ETH/BTC; use any dip for your RWA thesis.

5️⃣ Actionable Nuggs

Accumulating ETH below $2 K is effectively buying the rails to Wall Street’s tokenization spree.

Own the toolmakers: Protocols that automate issuance (Ondo, Centrifuge) historically front‑run the big headlines.

Watch the SEC clock: Ether ETF staking approval (decision window Q3) could redefine ETH as the only “yielding” large‑cap.

Zero‑mercy diligence: If a bank boasts tokenization but refuses Ethereum L1, question its commitment—and its security model.

🔚 Final Take

Ethereum is winning the $16 T tokenization race—in the same way Netflix was winning streaming in 2012. Victory isn’t a law of nature; it’s enforced by relentless narrative control and ruthless technical standards. ETH maxis don’t have to become toxic—just unapologetically clear: “Mint on L1 or get laughed off the block.”

Bitcoin, meanwhile, is flirting with a $3 B short‑squeeze cliff at $100 K. One clean breakout and the fireworks start.

Stay ahead. Keep risk tight. Stay Nugg’d.

-Nick

Founder, CryptoNuggs