Today’s Nugget:

Imagine if one protocol could fix DeFi’s biggest problems — liquidity fragmentation, idle capital, complex UX — and turn every dollar deposited into a yield machine.

That’s what Fluid is building.

Today we break it down in plain English, show how it works, and why it might be the next monster in DeFi.

(Happy Easter Special)

In crypto, every Easter egg is a hardware wallet…

Except instead of candy inside, it’s 12 words and crippling anxiety. 😂

Let’s dive in:

What is Fluid?

Fluid is the next-gen evolution of Instadapp — a protocol that helped pioneer gas-efficient lending, flash loans, and smart wallets starting in 2019.

Fluid’s goal:

Create a liquidity layer that powers lending, leverage trading, DEX activity, and tons of future financial services — all at once, with the same capital.

Why it matters:

Most DeFi protocols trap liquidity in silos.

Fluid aggregates it, recycles it, and multiplies its impact.

Result:

More yield for users.

More fees for LPs.

Way better efficiency for the entire system.

Key Innovations to Know

Capital Efficiency Without Fragmentation

One liquidity layer feeds multiple products (lending, trading, future perps, RWAs, forex).

Users can move between services without pulling liquidity, keeping capital active at all times.

Smart Collateral + Smart Debt

Collateral (e.g., stETH/ETH LPs) is used to generate yield and secure loans simultaneously.

Debt (borrowed stablecoins) isn’t idle — it’s deployed into DEX pools to earn trading fees and offset borrowing costs.

You earn on your collateral.

You earn on your debt.

You earn on everything.

Simulation Mode

Test strategies live with real-time Mainnet data — without risking real capital. Perfect for DeFi beginners or high-value strategists.

Next-Gen Liquidations

Instead of liquidating users one-by-one (high gas, high penalties), Fluid bundles liquidations and offers the bad debt as discounted liquidity to DEX aggregators.

Gas costs drop 3–4x.

Liquidation penalties drop 10–15x.

Smooth UX by Design

Vaults bundle complex DeFi strategies into one-click actions.

Uses Instadapp’s battle-tested Smart DeFi Accounts (DSA) and Avocado Wallet tech.

Fluid’s Full Ecosystem (Current + Coming Soon)

Layer | What It Does | Why It Matters |

|---|---|---|

Liquidity Layer | Core smart contracts where assets are pooled and managed | Prevents fragmentation across services |

Lending Protocol | Deposit assets and earn | Simple yield with real risk isolation |

Vault Protocol | Borrow/lend with ultra-high LTVs | State-of-the-art liquidation engine |

DEX Protocol | Trade with built-in smart collateral/smart debt recycling | Every transaction reinforces liquidity |

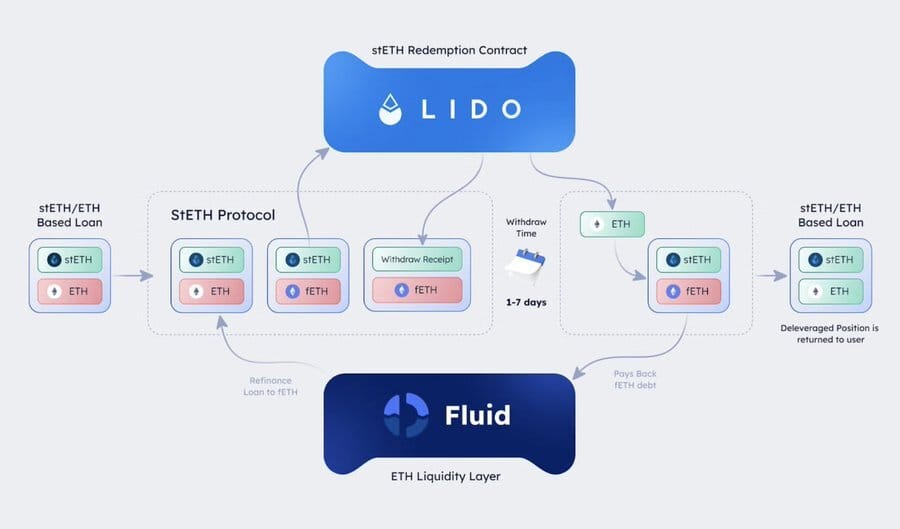

stETH Redemption | Deleverage stETH/ETH with low fees directly from Lido | Cut 10x the slippage vs traditional markets |

Business Model: Revenue Flywheel

Dynamic Trading Fees: Adjusts based on volatility to protect LPs while keeping trades active.

Revenue Sharing: Portion of trading fees + vault fees are captured and can be used for governance, treasury growth, and incentives.

Algorithmic Buybacks: Once revenue hits $10M/year, Fluid auto-buys $FLUID tokens when prices dip to stabilize price and reward holders.

Token Supply Strategy: Low circulating supply + treasury-held tokens gives room for aggressive buyback campaigns.

Efficiency Obsession: How Fluid 10x’s Capital

High LTVs: Up to 95% for highly correlated assets like wstETH/ETH.

Recursive Leverage: Capital can be recursively deposited and borrowed to achieve up to 39x effective liquidity relative to starting capital.

Gas Optimization: Custom coding tricks (memory slot recycling, variable packing, BigMath) to slash on-chain costs.

Translation:

More capital working harder. Less waste. Better yield.

On-Chain Momentum

TVL: Hitting fresh all-time highs almost monthly.

Trading Volume: Growing sharply, surpassing millions in daily turnover.

Revenue:

$10.4M–$20.8M annualized early in the year

$52M–$78M annualized now

Protocol P/E ratio around 9-10x — extremely cheap compared to peers.

Upcoming Catalysts

Fluid DEX V2: Massive upgrade to boost capital efficiency (launching soon).

Polygon Deployment: After Base + Arbitrum, Fluid expands to more chains.

New Products:

Forex Trading

Interest Rate Swaps

RWA Tokenization

Perpetual Contracts

Oracle Optimization: Redstone-powered gas-light Oracle and OEV revenue capture.

Final Nugget:

Fluid is a masterpiece of on-chain financial engineering —

combining Instadapp’s middleware genius with a bold new liquidity architecture.

It’s not just another DeFi app. It’s the financial base layer for crypto’s next bull cycle.

With strong growth, cheap valuation, and huge catalysts coming, Fluid looks positioned to lead the next wave of DeFi adoption.

If you’re serious about frontier tech and DeFi wealth-building —

this is a name to have on your radar before the crowd wakes up.

Adjust accordingly.

⚡ Stay ahead. Stay Nugg’d. Share this nugget with a friend who still thinks DeFi is “just farming on Aave.”

-Nick

Founder, CryptoNuggs