TL;DR: The crypto market still moves with Bitcoin $BTC.X ( ▼ 0.71% ) — whether you’re in altcoins, NFTs, or staking stablecoins, what BTC does still ripples through the entire space.

Last week, a few of you hit us with questions:

“What’s your read on Bitcoin right now?”

“Can you explain what mining even is?”

“Isn’t all the Bitcoin already out there?”

Today we’re breaking it all down — no fluff, no jargon — just a clean explanation of what mining is, why it matters, and how it all ties into where Bitcoin’s heading next.

Let’s dig in.

What Is Bitcoin Mining, Really?

Picture a massive, worldwide math race.

Every 10 minutes, thousands of machines compete to solve a puzzle. The first one to crack it wins new Bitcoin.

That’s how BTC enters circulation — not from a government or central bank, but from this trustless process called mining.

Why Does Mining Matter?

Because it powers everything:

It’s how new Bitcoin is created (up to the 21M limit).

It keeps the network secure — by validating every transaction.

It prevents cheating — you can’t spend the same Bitcoin twice because the entire network checks and records each move.

Think of miners as the referees, auditors, and security guards of Bitcoin — and they get paid in BTC to do the job right.

Back in 2009, you could mine Bitcoin from a laptop. Now? It’s mostly massive warehouses running specialized machines (ASICs) 24/7, burning electricity and chasing block rewards.

But here’s the kicker…

What Happens When All Bitcoin Is Mined?

We’re currently at about 19.7 million BTC mined.

Once we hit 21 million (around the year 2140), no more Bitcoin will ever be created.

So how do miners get paid after that?

Simple: transaction fees.

Every time someone sends BTC, a fee is attached — and that becomes the miner’s reward.

So mining continues. Bitcoin stays secure. The engine just shifts from printing new coins to processing transactions.

Why You Should Care

Mining is what keeps Bitcoin alive.

It’s the reason you can:

Trust that your BTC can’t be faked

Rely on a network with no middlemen

Know the supply is capped, verified, and fair

Without mining, Bitcoin dies.

That’s why this stuff matters — not just to devs and miners, but to anyone holding crypto.

Now — Let’s Talk Price

Last week’s structure has been shaky. Here’s what we’re seeing across the charts:

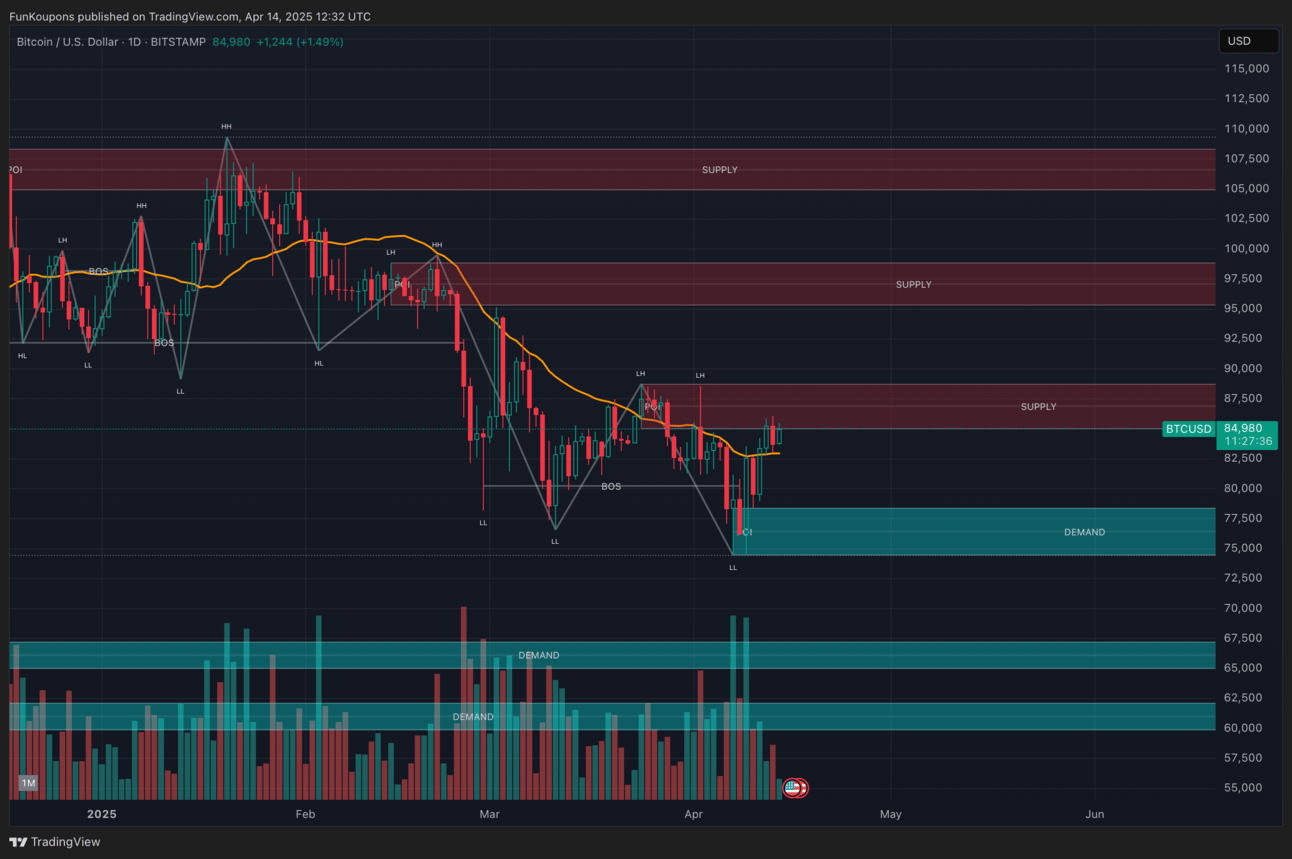

Chart 1: Breakdown & Reclaim Scenario

BTC lost key structure at $89K → bearish move

Bounced off $76K–$78K demand

Now trying to push back through $85K–$87K supply

If it clears $87K with volume?

We open the door for a run to $92K–$97K

If it rejects here again?

Price likely gets dragged back to $76K, with $73K as the line in the sand

Break $73K and we’re talking macro cycle failure

Chart 2: Supply/Demand Map

Supply zones stacked at:

$85K–$87K

$97K–$100K

$105K–$110K

Demand zones at:

$76K–$78K (recent bounce)

$68K–$70K

$61K–$63K (final boss support)

Currently sitting right on resistance.

We either flip this zone and start a new leg up,

Or reject and retrace hard.

Your Nugget to Bank:

This week’s close matters.

Above $87K = short-term bullish

Rejected here = eyes on $76K

$73K fails = get defensive

Watch volume. Watch closes. Don’t overtrade zone chop.

Bitcoin’s still king — and when the engine shakes, the whole market feels it.

Stay sharp. Stay Nugg’d.

— Nick

Founder, CryptoNuggs