TL;DR:

Q1 2025 was a gut-check. BTC and ETH bled. Fees cratered. But stablecoins and RWAs quietly hit escape velocity. Here’s the no-BS recap—plus what’s next for Q2 (especially if you’re watching RWAs and DeFAI closely).

Fees Fell Off a Cliff

Let’s talk network demand: it dropped hard.

BTC fees fell 57% in Q1. The Ordinals hype faded, and with it, a big chunk of on-chain activity.

ETH fees fell even harder—down 60%—thanks to the gas limit bump and shift to L2s post-Dencun.

Lower fees = less congestion, but also less revenue flowing to miners and stakers.

On Ethereum especially, that means stakers felt the pinch. Fewer txs on mainnet = weaker yield.

But here’s the nuance: fee drop ≠ bearish. Activity moved, it didn’t disappear.

And we’re seeing capital move smarter, not louder.

Exchange Flows Show Quiet Confidence

📤 BTC net outflows: $1.6B

📤 ETH net outflows: $1.9B

Coins are still leaving exchanges. That usually means long-term conviction or staking, not panic.

Q1 was rough, but not enough to shake serious holders.

Prices Dropped. Macro Took Over.

ETH got hit hardest—down nearly 50%.

BTC held up better, but still slid ~15%.

Why? Macro flipped:

“Soft landing” optimism turned into tariff fears + rate uncertainty.

Risk-off sentiment took over. Stocks dipped, crypto dipped harder.

Bullish headlines? They came, but the market didn’t care.

Even with the SEC dropping lawsuits, and banks getting greenlit to custody crypto, the narrative didn’t hold up.

Markets had priced in too much, too fast. Fragility set in.

Stablecoins? Different Story. Rocket Ship🚀

While tokens fell, stablecoins climbed:

Total market cap broke $220B—new all-time high.

USDT leads, but USDC jumped from 20% to 27% market share.

New entrants like PYUSD and RLUSD are gaining speed.

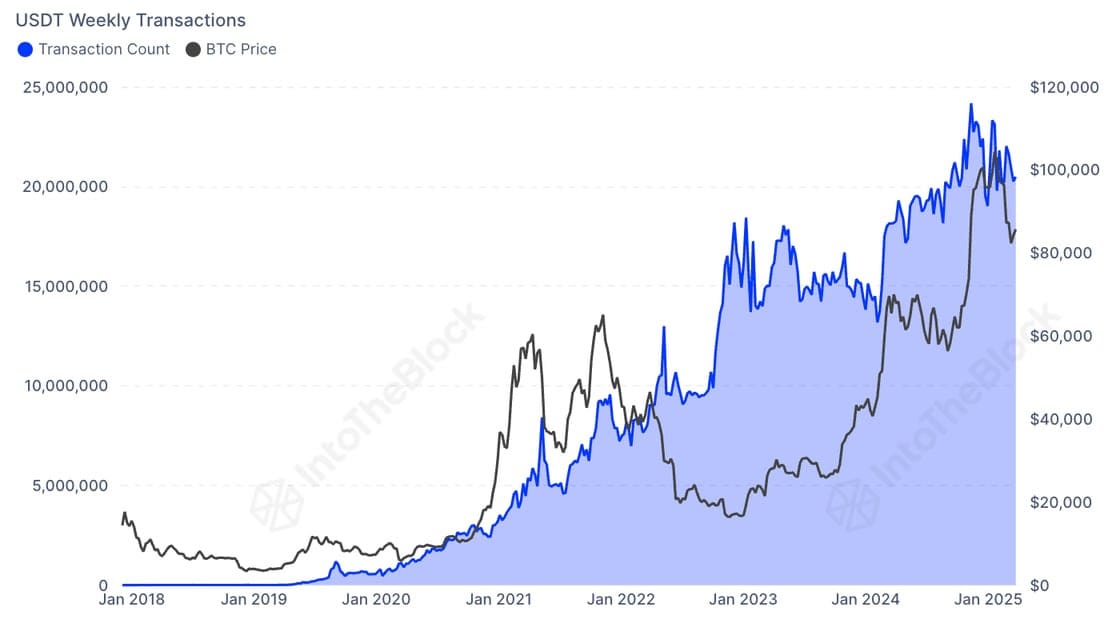

Stablecoins aren’t just growing in value—they’re actually being used:

Ethereum saw 200K+ daily active stablecoin addresses in March.

USDT hit 20M transactions/week across top 7 chains.

Real usage. Not speculation.

Stablecoins are crypto’s first killer app—and Congress is finally noticing.

📜 Federal stablecoin regulation is on the way.

💼 Fintechs and payment giants (like Stripe, PayPal) are gearing up.

The rails are being built—and dollars are going digital.

RWAs Hit $10B—And They’re Just Getting Started💰

Tokenized real-world assets (RWAs) quietly became one of crypto’s biggest narratives:

RWAs hit $10B+ in TVL for the first time.

BlackRock’s BUIDL fund tokenizing T-Bills now holds $2B.

MakerDAO backs $1.3B+ in RWAs to support DAI’s peg.

Why the boom?

Investors want real yield—and T-Bills still pay 5%.

Now they can get it on-chain, 24/7, globally.

And it’s not stopping at bonds…

Coinbase is exploring tokenized COIN stock on Base.

That opens the door to 24/7 tokenized equity trading.

TradFi meets DeFi. This isn’t vaporware—it’s already happening.

If BlackRock’s in, it’s not a fad.

Q2 Predictions: RWAs & DeFAI Will Lead the Pack🔮

RWAs Go Even Bigger

Expect more tokenized bond products, more TradFi players entering DeFi, and maybe the first tokenized stocks hitting real-world adoption. Liquidity is coming.

DeFAI Ramps Up

DeFi meets AI. Watch for new protocols that use AI to manage yield, optimize strategies, and automate trading. Could be a major unlock—or a major risk.

Regulation Becomes a Catalyst

Stablecoin legislation is nearing. If passed, it’ll clear the runway for more institutions to launch products, plug into DeFi, and trust the rails.

Final Take

Prices dropped. Fees dropped.

But real value creation didn’t slow down.

Stablecoins are being used globally, daily, at scale.

RWAs are onboarding TradFi capital and retail yield seekers.

Capital keeps flowing into what actually works.

Q1 flushed the hype.

Q2 will favor fundamentals, utility, and yield.

Stablecoins and RWAs are the signal.

DeFAI is the next wave.

Ignore the noise—watch where the value flows.

Stay sharp. Stay ahead. Stay Nugg’d.

— CryptoNuggs

/