TL;DR:

BlackRock’s tokenized money market fund, BUIDL, is the bridge between TradFi and crypto. With $1.8B AUM (Assets Under Management) in weeks and support across 7 blockchains, this isn’t hype—it’s a major move toward on-chain institutional adoption. Here’s why that matters.

What is BUIDL?

BUIDL is BlackRock’s first tokenized U.S. money market fund—a real-world asset (RWA) fund that lives on the blockchain.

It holds U.S. Treasurys, cash, and repo agreements just like traditional money market funds.

But instead of legacy rails, it runs on-chain.

Investors receive BUIDL tokens, pegged 1:1 to USD, with daily yield paid monthly as new tokens—straight to their wallets.

It’s the first time the world’s largest asset manager is letting investors earn yield from Treasurys through a blockchain interface.

Why BUIDL Matters for Crypto

✅ Legitimacy: BlackRock’s entrance sends a clear message—crypto infrastructure is institutional-ready.

⚙️ Adoption flywheel: BUIDL is already live on Ethereum, Solana, Arbitrum, Optimism, Avalanche, Polygon, and Aptos.

🌉 Mainstream access: For the first time, funds like Ondo ($95M into BUIDL), DAOs, and whales can park capital in U.S. Treasurys—without leaving crypto.

This isn’t a DeFi protocol raising hype. It’s a TradFi titan creating on-chain utility.

Why It Matters for TradFi

BlackRock just showed traditional finance that money market funds can be faster, cheaper, and more transparent using blockchain tech.

⏱ 24/7 Liquidity: No closing bell. Trade anytime.

⚡ Instant settlement: Capital moves faster, yields compound quicker.

💸 Lower costs: Fewer intermediaries = better margins.

This is TradFi, upgraded.

Behind the Scenes: How BUIDL Works

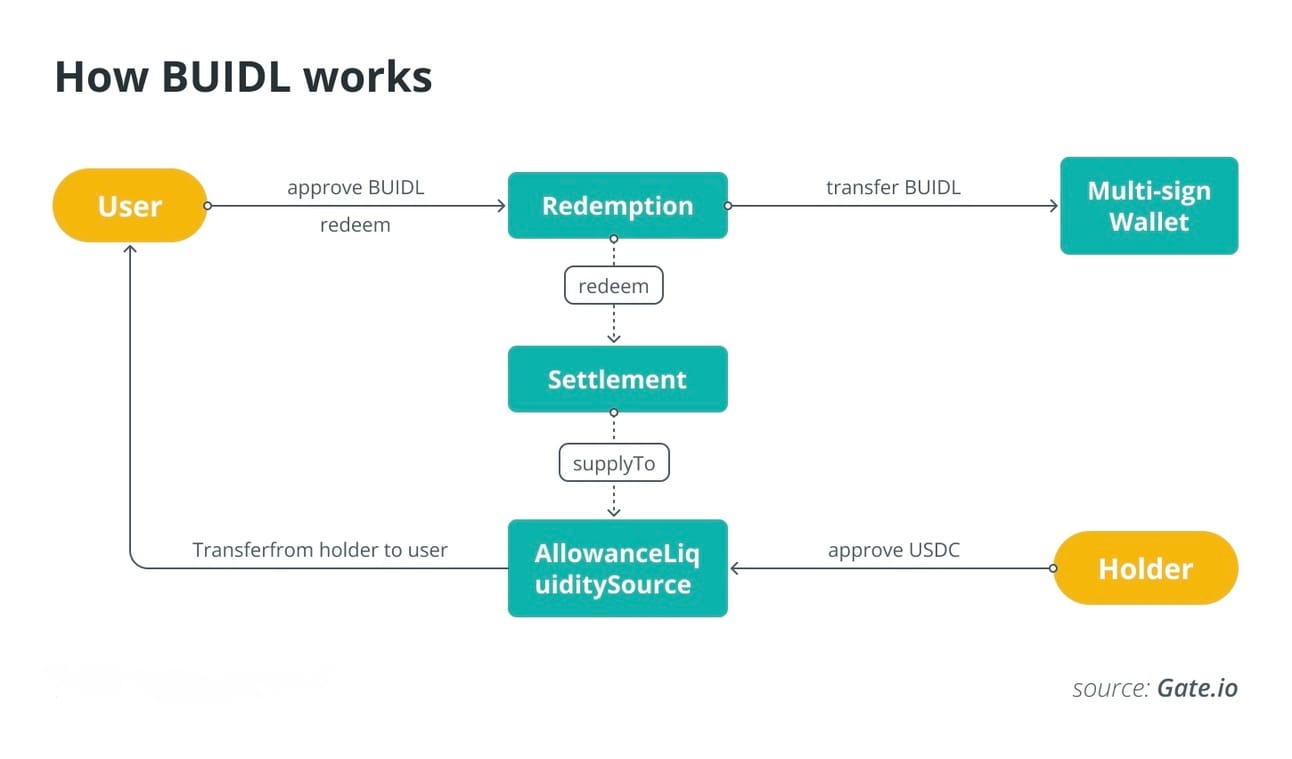

(See image above for visual flow)

🧾 User approves BUIDL tokens

🔐 Tokens are sent to a multi-sig wallet

What’s a multi-sig wallet?

It’s a special kind of crypto wallet that requires multiple approvals before any funds can move. Think of it like a vault that needs 2 or 3 keys to open. BlackRock uses this setup for added security and oversight—no single party can run off with the funds.

♻️ Redemption & settlement occur via smart contracts

💵 USDC is transferred from the liquidity source

📈 Yield accrues daily, paid monthly in new tokens

This is real-world asset tokenization—live, regulated, and scaled.

Who’s Jumping In?

Ondo Finance: Reallocated $95M into BUIDL in a week

Sky (ex-MakerDAO): Committed $1B+ to RWAs

Superstate: Passed $400M AUM

Franklin Templeton: $600B+ tokenized fund live

Figure Markets: Rolled out YLDS, a yield-bearing stablecoin

📈 This isn’t a trend—it’s a financial transformation.

Investor Benefits

⚡ Faster Settlement: Trade in hours—not days

🕒 24/7 Access: No closed markets, no downtime

💰 Daily Yield: Accrues daily, paid monthly in tokens

🔎 On-chain Transparency: Track assets live

🔐 Security: Protected by smart contracts + multi-sig custody

But Watch the Risks

⚠️ Thin liquidity: Still limited to qualified investors

⚠️ Smart contract risk: Vulnerabilities could expose the fund

⚠️ Market manipulation: Low volumes = higher volatility

⚠️ Counterparty risk: Failure of exchanges or partners could disrupt access

TradFi benefits meet crypto realities—investors need to understand both.

Final Take

BlackRock’s BUIDL isn’t just a new fund. It’s a signal.

When the world’s largest asset manager tokenizes Treasurys across seven blockchains and delivers yield on-chain, the game changes.

Crypto has begged for TradFi validation.

BUIDL is the green light—and the capital—to back it up.

Expect a wave of imitators. And prepare for a rush of institutional money.

Today’s Action Nuggs

🔍 Track BUIDL’s AUM growth—if momentum holds, others will follow

⚡ Look for DeFi integrations—BUIDL could plug into lending & treasury tools

🧠 Research competitors—Superstate, Ondo, Franklin Templeton

🧱 Explore RWA protocols—Centrifuge, Goldfinch, and more will benefit

Stay sharp.

-Team CryptoNuggs