Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

TL;DR: Ethereum isn’t just getting accumulated — it’s getting locked up. Today’s alpha:

🧊 BitMine just became the MicroStrategy of ETH (but with better tokenomics)

⚖️ SharpLink is stacking ETH faster than it can be printed

🧠 ETH Strategy is launching a leveraged ETH treasury protocol that dodges liquidation risks The ETH flywheel is gaining weight… and it’s not slowing down.

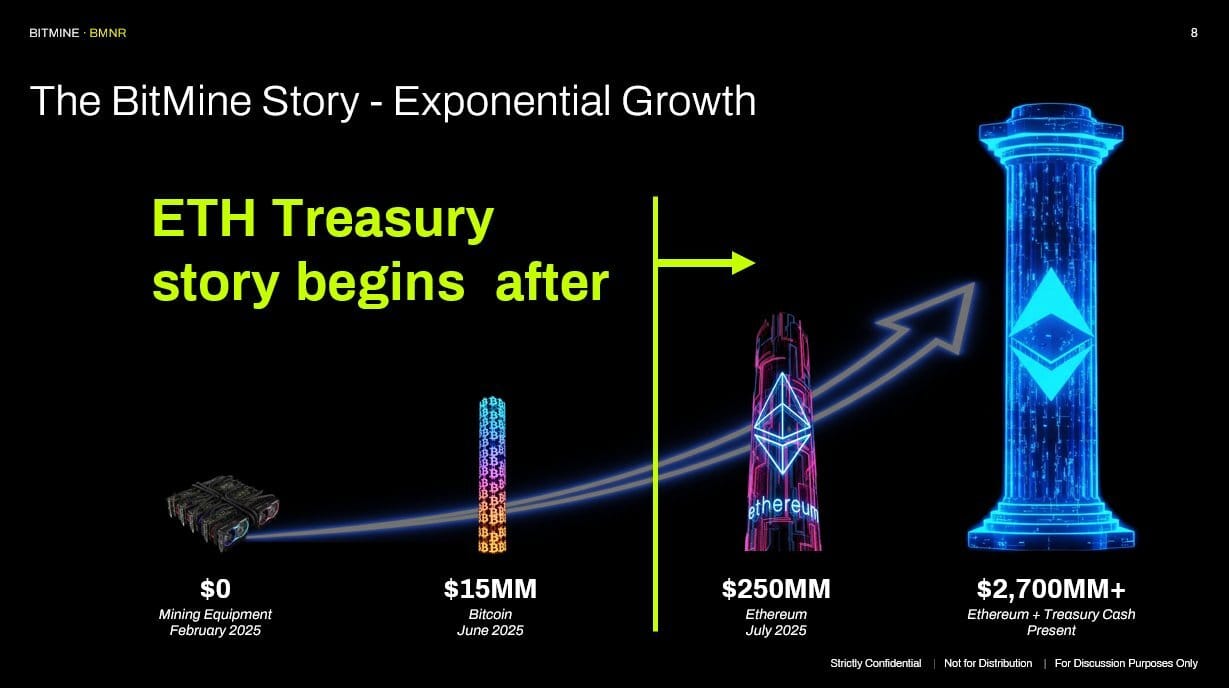

🧱 BitMine Is Now an Ethereum Whale (and Buying Back $1B of Its Own Stock)

Tom Lee’s BitMine isn’t just pivoting to Ethereum — it’s going all in.

Here’s what just happened:

📌 BitMine Holdings ($BMNR):

✅ Now holds 625,000 ETH (~$2.4B)

✅ Just approved a $1B stock buyback program

✅ NAV per share: $22.76

✅ Cash balance: $401M+

✅ Also holds 192 BTC (~$22.8M)

🎯 Long-term target: Own & stake 5% of all ETH

🧠 As Tom Lee put it:

“In our road to achieving ‘the alchemy of 5%,’ there may be times when the best expected return is to buy back our own shares.”

This is the MicroStrategy model — but with a harder, more productive asset.

$ETH.X ( ▼ 0.95% ) gives native yield. ETH supply goes down. ETH has utility.

Bitcoin? Just sits there.

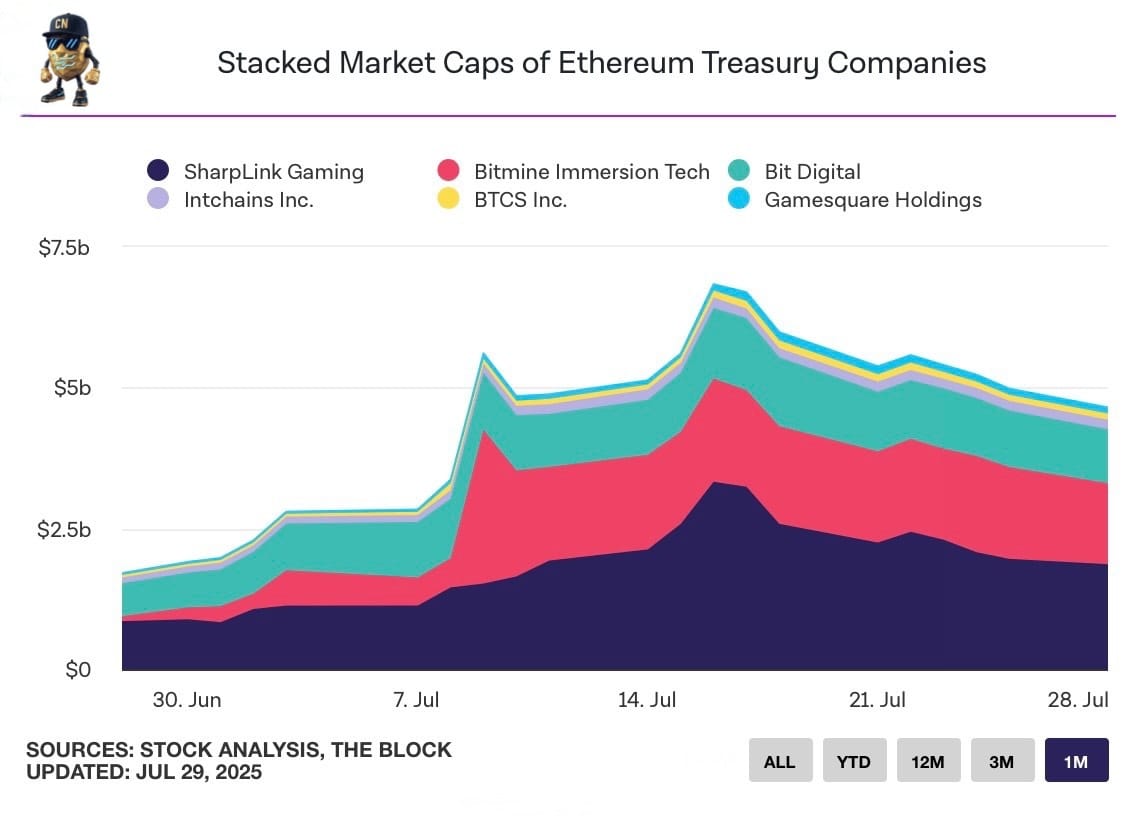

💥 SharpLink Adds Another 77K ETH — Now Holds 438,190

SharpLink isn’t just keeping pace — it’s speeding up:

📌 SharpLink Gaming (SBET):

🆕 Just acquired 77,210 ETH last week

🪙 Total holdings: 438,190 ETH

💸 Spent ~$290M at an average price of ~$3,756

⚖️ ETH-per-share (concentration): 3.40, up from 3.06

📈 ETH staking rewards: +722 ETH

ETH isn’t just on their balance sheet — it’s yielding.

📌 They’re not flipping coins. They’re compounding.

⚙️ ETH Strategy Is Launching — Treasury Protocol With Leverage (Minus Liquidation)

ETH Strategy just raised 12,342 ETH (~$46.5M) to launch a new type of protocol:

→ Leveraged ETH accumulation without liquidation risk.

📌 Here’s what you need to know:

📍 Public sale: 1,242 ETH

📍 Private presale: 6,900 ETH

📍 Puttable warrants: 4,200 ETH

🪙 Token: $STRAT

🔒 4-month lockup, then 2-month linear vest

💡 Deployment plan:

11,817 ETH for staking + liquidity

525 ETH for protocol growth, audits, ops

📍 Launching on Uniswap v4 with an ATM single-sided pool

Why it matters:

This is an evolution of the SharpLink/BitMine model — protocol-native treasuries that use bonding, leverage, and non-liquidation debt issuance to build ETH-per-share flywheels.

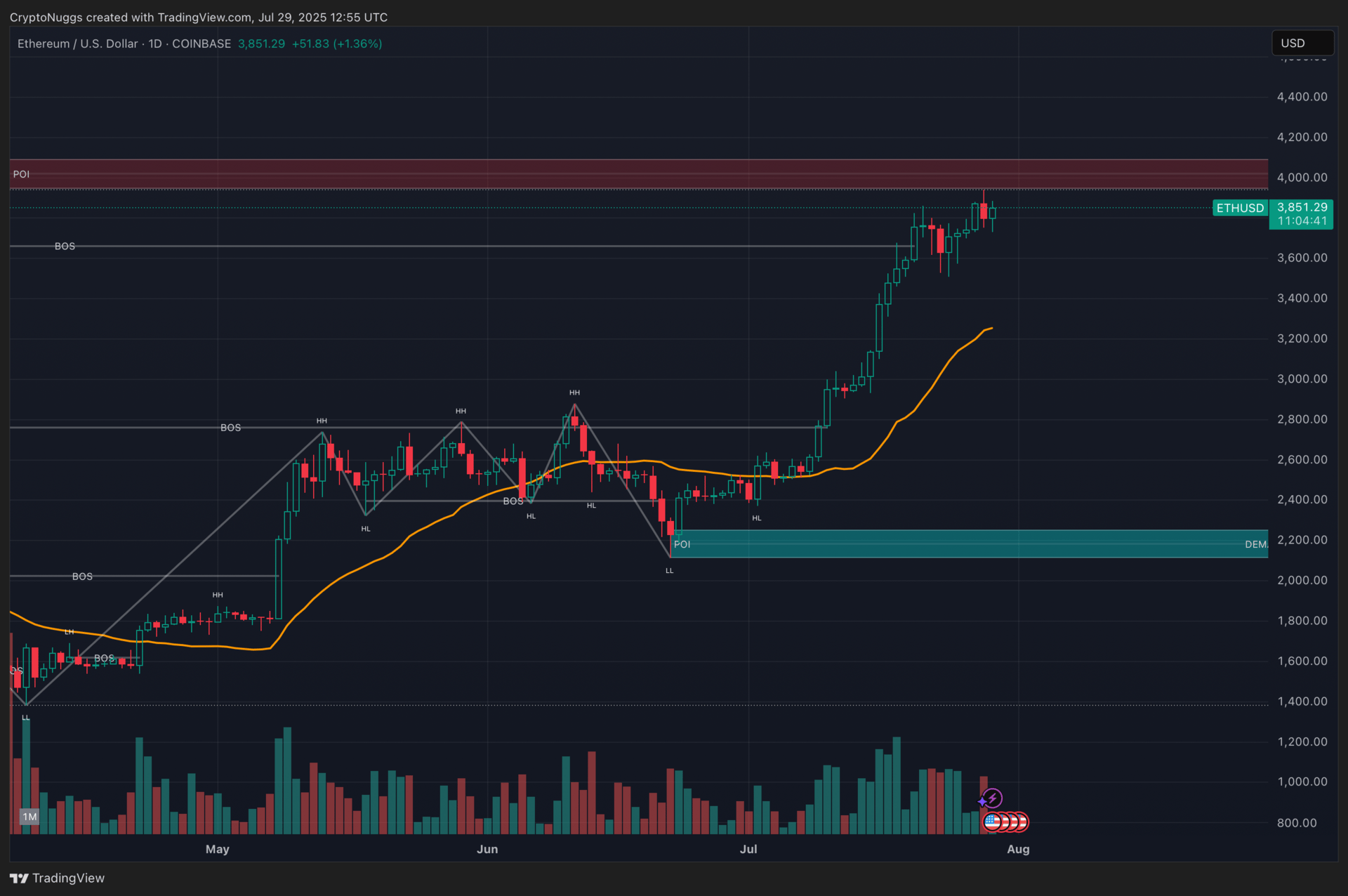

🧠 One Way to Look at ETH Right Now

This stat hits different:

SharpLink + BitMine have acquired 82% of all ETH issued since The Merge.

That’s 298,770 ETH in just one month.

Meanwhile, spot ETFs hold 4.11M ETH — that’s 11x the net issuance.

🛢️ Think of ETH like a rare oil mine.

It emits 1 barrel a day, while Wall Street consumes six.

And on top of that:

🔥 ETH burns when usage spikes

🧱 ETH is staked by validators

🧲 ETH is being hoarded by corporate treasuries

💡 Ethereum isn’t just digital oil — it’s programmed to become the most deflationary mainstream asset in existence.

Anyone in the world can own it today for $3,850.

That price is looking real temporary.

📉 Meanwhile, Bitcoin Faces Its Own Treasury Risk

While ETH is being locked, staked, and bought back, Bitcoin’s future as a treasury asset is facing heat.

Here’s why:

🧱 BTC can’t stake

❌ No native yield

🏦 Mostly sits idle unless it’s lent via risk-on strategies

⚡ ETF inflows are solid — but don’t reduce float supply like ETH burns/staking do

🧯 Supply is still inflationary for now

📉 Treasury incentives are weaker vs ETH’s compounding model

That’s not an anti-BTC stance — it’s just the math.

ETH and BTC can absolutely coexist — but right now, ETH is the one being acquired and put to work.

🔥 Final Take

You’re watching the birth of an Ethereum capital market.

Public companies are compounding ETH-per-share.

Protocols are offering structured ETH yield & leverage.

ETFs are pulling ETH off the market with 0 emission offsets.

This isn’t a trend. It’s a blueprint.

If you believe ETH hits $10K, $50K, or $100K in the future…(Lee is predicting $704,000)

You’re watching the institutions that will front-run you get in now.

And for once — you can front-run them back.

Call to Action:

🧠 Stay sharp. Stay staked.

🏴☠️ Get your Nuggs daily. Get your ETH.

-Nick