Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Is Ethereum actually winning the real-world asset race? Or just coasting on reputation?

So here’s the honest answer:

Yes, Ethereum is dominating. But it could still lose.

Let’s break it all down.

The $16T Prize: Global Tokenization of Real-World Assets (RWAs)

Boston Consulting Group forecasts $16.1 trillion in RWAs onchain by 2030. That’s the biggest prize in crypto—bigger than DeFi, bigger than memecoins, bigger than NFTs.

And right now? Ethereum is leading the race by a mile.

$6B+ in tokenized RWAs already live on Ethereum

93% of BlackRock’s BUIDL capital deployed on ETH

New $1B real estate deal inked via Ethereum-based Blocksquare

But as Sam Kazemian (Frax founder) put it, “Nice guys finish last.”

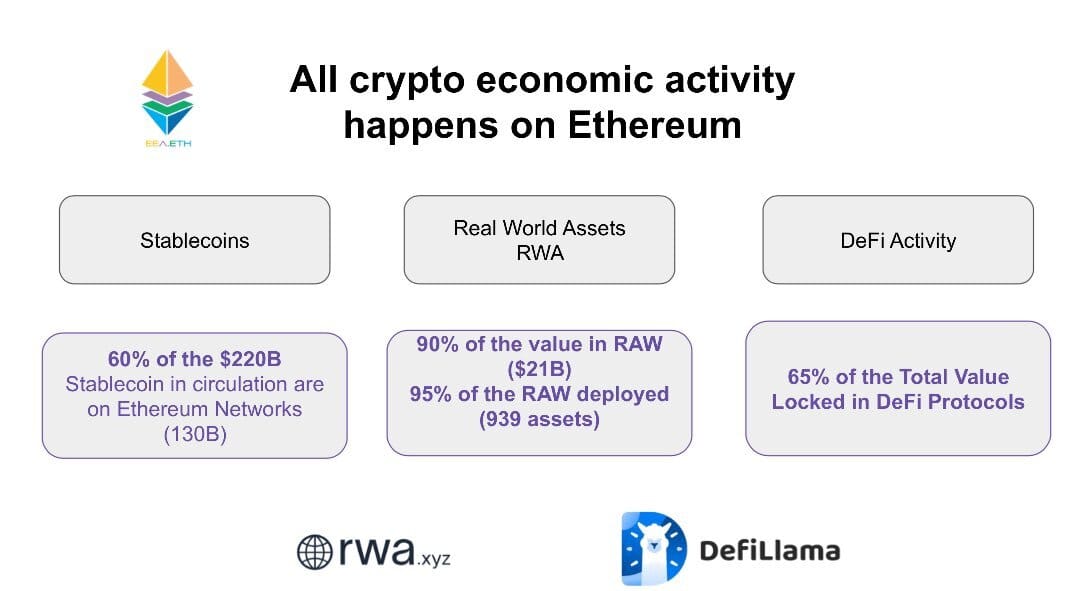

The Data: ETH Dominates RWAs, DeFi & Stablecoins

Ethereum: $5.98B in RWA value

ZKSync Era (also ETH-based): $2.2B

Others like Solana, Aptos, and Algorand: $300M–$330M range

Ethereum stablecoins: $127B of the $220B in circulation (56.4%)

ETH accounts for 65% of all DeFi TVL

If you care about liquidity, security, and composability—there’s no safer bet than Ethereum.

But Wait… BlackRock’s RWA Token Is Multichain

Here’s where the tension comes in.

BlackRock’s BUIDL token, backed by US Treasuries, is on 7 blockchains: Ethereum, Solana, Aptos, Arbitrum, Polygon, Avalanche, and Optimism.

Even though 93% of the funds are still on ETH, the token’s multichain design undermines Ethereum’s advantage.

“If a token is redeemable globally, the Ethereum network isn’t the source of truth anymore.” — Sam Kazemian

To win this race long-term, Ethereum has to become the only credible ledger for serious institutions.

And that might require ETH maxis to get a little less polite and a lot more persuasive.

Wall Street’s Bull Case for Ethereum

Why are the biggest TradFi players still choosing ETH over faster, cheaper chains?

Because institutions think in risk, not speed.

And when moving billions, credibility > gas fees.

“The default answer for tokenization is Ethereum.”

— Robbie Mitchnick, BlackRock Head of Digital Assets

“Tokenized asset flows are increasing because clients care about security and decentralization.”

— Vivek Raman, Etherealize

Retail Doesn’t Get It… Yet

Despite ETH crushing it in fundamentals, Wall Street isn’t buying the token itself yet.

Bitcoin ETFs: $94.5B

Ethereum ETFs: $4.57B

Why the gap? Ethereum’s value isn’t easy to narrate.

BTC = Digital gold.

ETH = ??? (Smart contracts? World computer? Gas token?)

But that could change fast…

Staking = Ethereum’s Secret Weapon

This year, ETF approval for staking could flip the script.

3–5% yield.

Institutional exposure to onchain activity.

Programmable financial instruments built on yield.

TradFi loves fixed income products. And ETH is the only major crypto with native yield.

Final Take: Ethereum Is Winning. But It Can’t Get Comfortable.

ETH is the backbone of the RWA economy:

95% of all RWA tokens by asset count live on Ethereum

BlackRock, Fidelity, Sony, Deutsche Bank, UBS are all building on it

7x more TVL than Solana

60% of stablecoin supply

Most DeFi integrations

But tokenized finance isn’t just about technology. It’s a war for mindshare.

“Ethereum needs to become the ledger of truth. If it’s on anything else, it’s bullshit.”

— Sam Kazemian

If ETH wants to lock this in… it can’t just be the best.

It has to be loud about being the best.

Actionable Nuggs

Bullish ETH long-term — tokenization flows are picking up, and ETH is the default pipe.

Watch RWA platforms building on ETH — names like Maple, Centrifuge, Blocksquare, and Securitize will keep gaining momentum.

Staking narrative is underpriced — if staking is greenlit for ETH ETFs, expect serious rotation in.

Happy Sunday gang ⚡️

-Team CryptoNuggs