Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

You’re going to see this headline and think, “Has Nuggs gone crazy?”

But by the end, you’ll be saying: “I need to get ready for the bull market.”

Yes, Bitcoin $BTC.X ( ▼ 1.16% ) went from $16K to $110K over the past 3 years…

But ask yourself — has it felt like a true bull market yet?

No euphoria.

No alt season.

No memes pumping 100x in 4 hours.

Just institutional Bitcoin adoption… and a bunch of altcoin rugged dreams.

Let’s break this down using macro data, historical context, and the 12 liquidity levers that actually ignite crypto manias.

🔍 What Actually Drives Bull Markets?

It’s not just the 4-year halving cycle.

It’s not just vibes and memes.

It’s macro liquidity — and when liquidity floods the system, everything pumps.

Jesse Eckel on YouTube laid it out brilliantly. I’ve repackaged his analysis for you here.

He breaks it into “The 11 Liquidity Rings of Power” — and the one ring that rules them all.

Let’s go:

🧠 The 11 Liquidity Rings of Power

These are the actual macro levers that must be pulled to trigger market-wide mania:

Rate Cuts – Lower borrowing costs = more debt = more liquidity

Quantitative Easing (QE) – Central banks inject cash into markets

Forward Guidance – Pledging low rates for longer

Lower Reserve Requirements – Banks can lend more

Relaxed Capital Rules – Institutions take more risk

Loan Forbearance – Keeps credit flowing even through pain

Bailouts/Backstops – Prevent collapse, restore trust

Massive Fiscal Spending – Stimulus, infrastructure, war money

TGA Drawdowns – US Treasury spending its cash pile

Foreign QE – Global liquidity flows into crypto

Emergency Credit Lines – Crisis-mode liquidity firehoses

Every time a true crypto bull market has ignited, multiple of these rings were fully activated.

🧨 The One Ring That Ignites Them All: Economic Pain

Why don’t they pull these levers constantly?

Because they only act when pain forces them to.

Examples:

2008 Crisis → QE + Bailouts + Rate cuts

2020 COVID Crash → Stimulus + QE + Everything

2024? Not yet. But we’re getting there.

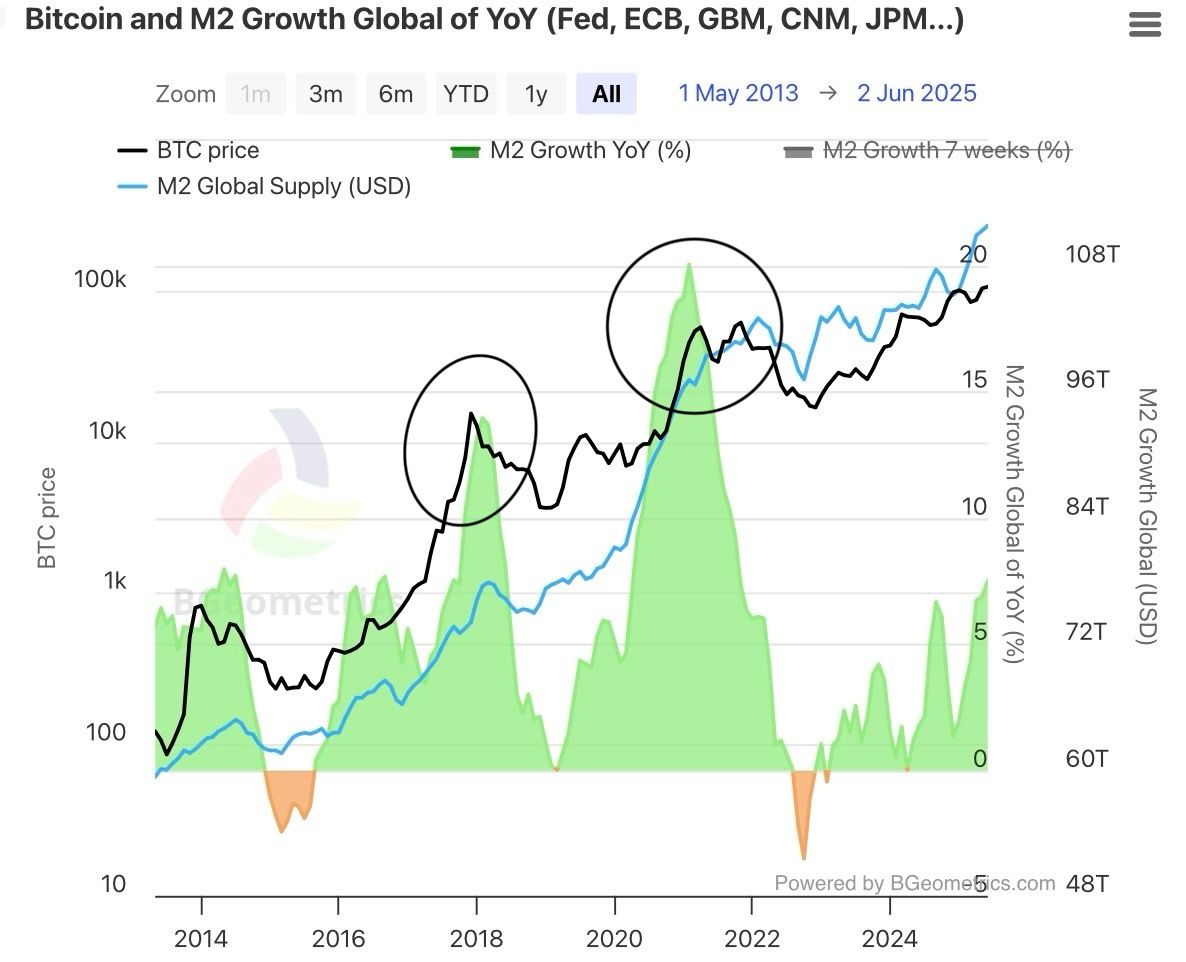

You’ll see Bitcoin’s biggest runs only happened after massive spikes in M2 growth. Right now? It’s barely budging.

📉 Most Liquidity Rings Are Still OFF

Despite Bitcoin hitting new highs, the liquidity engine isn’t on yet.

This is why altcoins are lagging.

This is why there’s no memecoin mania.

This is why NFTs aren’t flying yet.

This is why the bull market feels… quiet.

The final blow-off move in the 2017 altcoin cycle — ending with a high-volume doji, signaling the market’s top.

Altcoin Breakout Candle That Kicked Off 2021 Mania

This final green candle marked the moment altcoins broke out of consolidation and ignited the full bull market. It followed a reset phase (multiple red candles) and cleared prior resistance — a textbook breakout that led to explosive gains across NFTs, L1s, and DeFi.

🧠 Historical Liquidity vs Bull Markets

Every single cycle started AFTER macro liquidity surged:

2013

QE active

0% interest rates

High gov’t spending → BTC: $15 → $1,000

2017

Rates still low

Japan + Europe doing QE → BTC: $1,000 → $20,000

2021

All levers maxed out

M2 growth >25% → BTC: $3,000 → $69,000

Today? Most levers are idle.

^ Every peak followed after a monetary explosion.

📊 Key Signals to Watch Right Now

M2 Money Supply (YoY Growth)

This tracks how fast broad money is expanding.

Big bull markets always follow steep M2 acceleration.

We’re climbing, but not spiking. Flat M2 = slow grind.

ISM Manufacturing PMI

A business cycle health check. Over 50 = growth.

Bull markets love PMI 60+.

We dipped back below 49 = contraction. Not bullish macro yet.

🧨 Why This Matters

Retail thinks the bull market has arrived.

But the macro fuel isn’t there.

There’s no tsunami of new money.

There’s no frothy mania.

There’s no speculative orgy yet.

Instead, Bitcoin’s rise is:

ETF demand

Institutional inflows

Dollar cost averaging

This is Act I of the bull run — the responsible money.

Act II (liquidity-driven mania) hasn’t started.

📌 Final Take: The Bull Market is Still Loading

You’ve seen the charts.

You understand the macro levers.

This market still has crazy upside, but if you feel like you “missed the run”… you haven’t.

We’re still waiting for the rings of power to ignite.

When they do — the real mania begins.

So position smart. Stay liquid. And watch the macro.

Because the moment pain flips to liquidity…

You’ll want to be in position.

And as always, stay sharp. Stay Nugg’d. We got you. 🤙

-Nick

Founder, CryptoNuggs